Capital Gain Tax Rates and the Benefits of 1031 Exchanges

Exchanges Defer the 3.8% Net Investment Income Tax and 20% Capital Gain Tax

|

The familiar adage, “It’s not how much you make, but how much you keep” rings truer than ever for real estate investors facing today’s high tax rates. Fortunately, IRC Section 1031, a provision in the tax code since 1921, provides critically needed tax relief. For the full article, including the 4 Steps Involved in Determining Capital Gain Taxation and a chart showing the combined federal tax rates, Read More… |

|

1031 Basics: The Power of Green 1031 Exchanges

|

As a leading Qualified Intermediary working with investors nationwide, we at Asset Preservation know that the environmental movement is no passing fad, but is instead becoming a vital component in more and more investment transactions. Many of our exchange customers are investigating renewable energy and other eco-friendly exchange alternatives. Exchanges involving wind energy and solar power fields can help increase renewable energy sources and reduce carbon omissions. Additionally, the sale of conservation easements and the purchase of LEED certified replacement properties are both becoming strategies to provide full tax deferral while achieving environmental objectives. Through Section 1031 of the tax code, the green you save can be more than money. Read More… |

Tax Freedom Day: April 21, 2014

Tax Freedom Day 2014 is April 21, three days later than last year. What is Tax Freedom Day? Tax Freedom Day is the day when the United States as a whole has earned enough money to pay the total tax bill for the year. Tax Freedom Day essentially divides all federal, state, and local taxes by the nation’s income. Read More…

Best and Worst Markets for Rental Returns

Income producing rental properties allow investors to build wealth over the long term through appreciation while also generating monthly income. Many cash-flow rentals can be found throughout the United States. However, today’s rapid appreciation is making it more difficult. To see the current best and worst markets for rental returns, Read More…

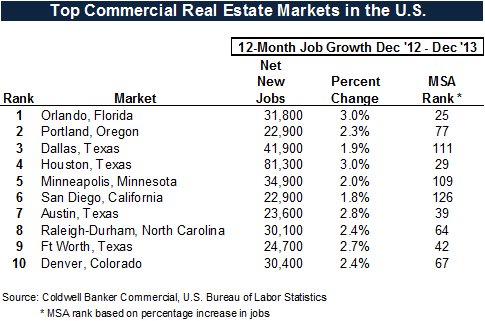

Another Top-10 List — Best Markets for Commercial Real Estate

Where are the strongest commercial markets in 2014? Coldwell Banker Commercial® analyzed the top 80+ markets in the country ranking office, retail and multifamily segments based on changes in vacancy and rental rates. They scored the change in the population of market for the same period, plus the change in unemployment to arrive at real estate market performance measures and indicators of overall economic health. The relative rankings within each property type are included in the 32 page report, including commentary on the top 10 markets and detailed statistics. To download the 2013 Blue Book 32 page report from Coldwell Banker Commercial® click http://www.mmparrish.org/web/beau/Top_CRE_Markets.pdf

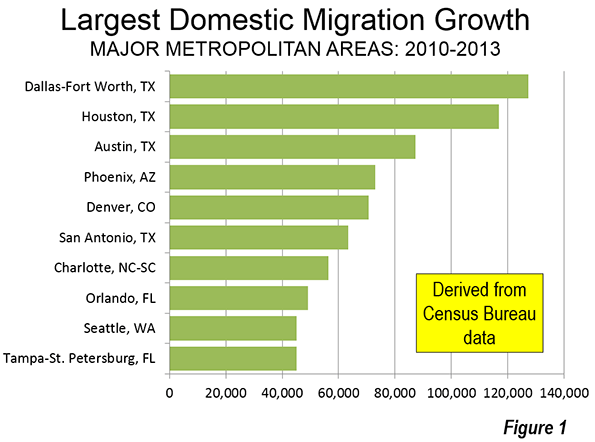

Biggest Growth Metros in Absolute Numbers

The 2013 annual metropolitan area population estimates by the US Census Bureau indicate a continuing and persistent dominance of population growth and domestic migration by the South. Between 2010 and 2013, 51 percent of the population increase in the 52 major metropolitan areas (over 1 million population) was in the South. The West accounted for 30 percent of the increase, followed by the Northeast at 11 percent and eight percent in the North Central (Midwest). Read More…

Attend a Complimentary 1031 Exchange Webinar (1hr CPE Credit)

Title: The Power of Strategy: Mastering 1031 Tax Deferred Exchanges

Presenter: Scott Saunders, Asset Preservation, Inc.

Course Description

This one hour course provides a concise and thorough overview of IRC Section 1031 tax deferred exchanges for accountants, CPA’s and tax advisors. In addition to covering critical IRS time deadlines, like-kind requirements and other exchange-related issues, the class will provide a summary of current developments including applicable Revenue Rulings, PLR’s and other IRS guidance on current issues related to exchanges.

Course Details:

Date: Tuesday, April 29, 2014

Time:

9:00 a.m. – 10:00 a.m. (PST)

Cost: Free

CPE

Credits: 1.0 hour (Accountants & CPAs)

Click here to View Details and Registration Info at cpaacademy.org

1031

1031 Past

Past