Due Diligence When Recommending a QI & Other 1031 Updates

Due Diligence When Recommending a QI

|

Have you examined your qualified intermediary (“QI”) lately? Are you sure your exchange funds are secure? Although a small number of states have enacted regulations governing IRC Section 1031 exchange QI companies, there are no Federal regulations regarding QI’s and the safeguarding of exchange funds. Accordingly, it is important for both the taxpayer and the taxpayer’s tax/legal advisors to perform due diligence before choosing a QI company. The importance of this can be seen in the case, Winters v. Dowdall. In that case, the taxpayer sold a relinquished property in New York and retained Patrick Dowdall, of the law firm Dowdall and Associates, P.C. (“Dowdall”), purported experts in the field, to provide guidance with their 1031 exchange, and specifically with the selection of a QI. The Court ultimately determined that Dowdall did not adhere to their duty to perform sufficient due diligence because they did not sufficiently investigate the QI prior to recommending the QI to the taxpayer. Due Diligence When Recommending a Qualified Intermediary. |

|

1031 Basics: Replacement Property Calculation

|

In an IRC Section 1031 tax deferred exchange, the tax basis of the replacement property starts out as the tax basis of the relinquished property. IRC Section 1031(d) then requires these further calculations: the basis of the replacement property is: (i) decreased by the amount of money received in the exchange, and (ii) increased (or decreased) by the amount of gain (or loss) recognized in the exchange. Treas. Reg. §1.1031(d)-1(e) requires further calculations for exchanges involving multiple relinquished properties, some of which are not like-kind. Although most taxpayers will rely upon the calculations provided by their tax and/or legal advisors, the formula for determining the tax basis in the replacement property is reflected in this article. Replacement Property Calculation. |

U.S. Home Values Seen Gaining Most Since ’05, Zillow Says

"U.S. homes gained $1.9 trillion in total value this year, the biggest jump since 2005, as the real estate market rebounded from the recession," according to Zillow. Read More…

Final Section 1411 (3.8% Net Investment Income Tax) Regulations Released

Tax deferred exchanges under Section 1031 of the Internal Revenue Code allow real estate investors to defer taxes that would be due if the property was sold instead of exchanged. The taxes owed on a sale could potentially include: 1) depreciation recapture at 25%; 2) the applicable Federal capital gain tax rate (15% or 20%, depending upon the investor’s income); the applicable state tax rate (0% – 13.3% depending upon the state tax rate); and an additional “net investment income tax” under IRC Section 1411 for capital gain and other passive income over certain threshold amounts ($200,000 for single filers and $250,000 for married filing jointly). A 1031 exchange provides the opportunity for any property owner using a property in their business or holding for investment purposes to defer all of these taxes.

The new and higher tax rates in 2013 resulted in an approximate 50% increase in 1031 exchange activity. Recently, on November 27, 2013, the IRS issued final and proposed regulations giving guidance on the application and computation of the 3.8% net investment income tax imposed by Section 1411. To read the final regulations, click on T.D. 9644 and REG-130843-13.

Call Us

|

|

Asset Preservation would appreciate the opportunity to work with you on your next exchange regardless of how simple or complex. Give us a call at 800-282-1031 to open a 1031 exchange. Or to open a 1031 exchange online, email us at info@apiexchange.com. API is committed to providing its exchange customers with unmatched service, and the highest level of security available in the 1031 exchange industry. From the customer’s first contact with an API representative, API’s professional exchange counselors, attorneys and accountants work together to meet the customer’s service needs in order to ensure a smooth transaction with no surprises. In the background, API’s management maintains tight financial controls and multi-layered security systems necessary to provide a level of comfort and performance quality relied on by sophisticated investors and corporate America; we call it the “The API Advantage™.” |

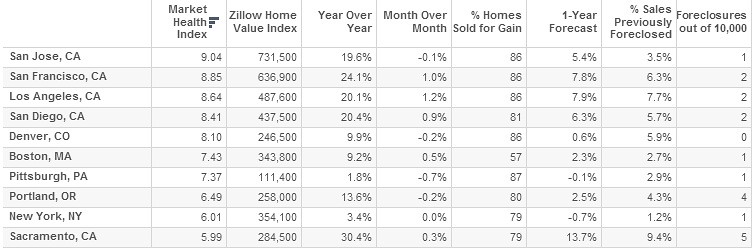

Zillow’s: Healthiest Markets for 2014

Zillow economic researcher Skylar Olsen spins up strong testimony to the choppy-ness and lumpiness of the housing recovery.

Based on data from Zillow’s inaugural Market Health Index, says Olsen, "The Market Health Index is our guy with the color wheel, carefully comparing metros along one summary metric. The Index blends 10 descriptive statistics that benchmark home value rebounds (or continued declines), the time homes stay on the market, and the financial health of homeowners." Read More…

Attend a Complimentary 1031 Exchange Webinar (1hr CPE Credit)

Title: The Power of Strategy: Mastering 1031 Tax Deferred Exchanges

Presenter: Scott Saunders, Asset Preservation, Inc.

Course Description

This one hour course provides a concise and thorough overview of IRC Section 1031 tax deferred exchanges for accountants, CPA’s and tax advisors. In addition to covering critical IRS time deadlines, like-kind requirements and other exchange-related issues, the class will provide a summary of current developments including applicable Revenue Rulings, PLR’s and other IRS guidance on current issues related to exchanges.

Course Details:

Date: Tuesday, April 29, 2014

Time:

9:00 a.m. – 10:00 a.m. (PST)

Cost: Free

CPE

Credits: 1.0 hour (Accountants & CPAs)

Click here to View Details and Registration Info at cpaacademy.org

1031

1031 Past

Past